It’s National Numeracy Day and now is the perfect time to talk about how being confident with numbers as an adult can have a HUGELY positive impact on your life and your finances. We’re a long way from the classroom now and you don’t need to be a whizz at long division to become a pro at managing your money so let’s talk about Basic Budgeting: the two numbers EVERYONE should know!

NUMBERS YOU NEED TO KNOW: INCOME.

It may sound obvious but could you tell me with confidence right now EXACTLY how much money you have coming into your household each month?

Maybe you know your annual salary or have a rough idea how much money you take home each month but there are many things that can affect this, not least of which are the various tax and national insurance changes we’ve seen in recent months. Accurately knowing how much money comes in to your household each month is a vital first step to creating a budget that works.

If you’re a little hazy on the numbers, don’t fear – There are a few things you can do as part of your payday routine to make sure you’ve got a proper grip on your income.

Firstly, check your payslips each month to make sure your wages are correct. Are you on the right tax code? Do you know how much do you pay into your pension? What other deductions should come out of your wages? Get familiar with these details so that it’s easier to spot when something isn’t right. You can always ask your HR or payroll department for help if you’re unsure.

Don’t forget to factor in any additional income including entitlements such as child benefit. If you recently worked overtime or were due a bonus or commission, make sure this has been processed properly. If you have a side hustle or business, keep a running log of your income and ensure to account for any tax you may owe on this income before you include it as part of your income total.

For those who are part of a double income household and don’t already do this – Talk about money! You’re a team for a reason so make sure you know what your partners income is and how this affects your family budget. My family budgets as a household so all of our money goes into one big metaphorical pot and we go from there.

Now we know what our monthly income is, it’s time to move on the next, slightly more complicated step.

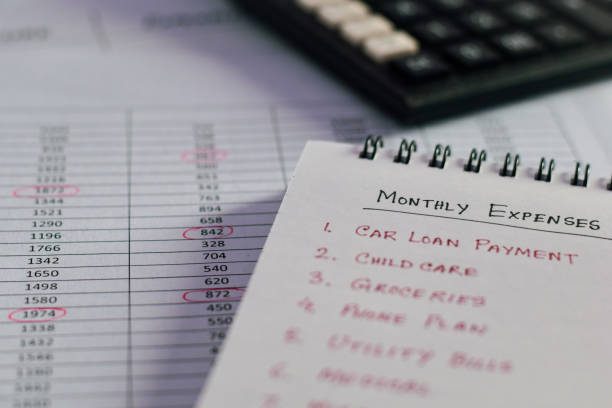

NUMBERS YOU NEED TO KNOW: OUTGOINGS – PART ONE (FIXED EXPENSES).

With the first key component of a successful budget being a strong knowledge of your income, I hope it’s not going to come as too much of a shock that the second stage is being fully aware of your outgoings.

Outgoings are a little more complicated than income and there are a few steps to properly understanding the true picture of your outgoings and the first task is to calculate your fixed expenses (AKA bills).

Here’s a little insight into the routine I follow to make sure I’ve got a tight grip on my regular monthly payments:

Firstly I open up my online banking app and I start at my last payday. I go through every single transaction and make a note of all the regular payments (AKA bills and subscriptions). You can use a budget planner, a budgeting app or good old fashioned pen and paper – I personally use a basic excel spreadsheet. I have tabs to enter the dates the payments come out, which bank account they come out of and any other useful notes such as what my current interest rates are or when a fixed deal is due to end.

I review this list on a regular basis and check it against my online banking as we all know that a lot of our bills are increasing frequently at the moment thanks to the current cost of living crisis.

This is also a useful cost cutting exercise as it doubles up as a monthly review of your expenditure. Analysing your bills may have highlighted that you’re paying for unused or unnecessary subscriptions that you can cancel or that you are out of contract and able to renegotiate a service such as your broadband package.

NUMBERS YOU NEED TO KNOW: OUTGOINGS – PART TWO (VARIABLE EXPENSES).

Bills are only part of the story when it comes to outgoings so next we need to move onto your variable expenses.

Variable expenses are essentially your living costs. Things you will need to fork out for but that you have some control over as opposed to bills which tend to be fixed amounts. The only real way to work out your variable expenses is to complete a spending tracking exercise.

When you create your first budget, it can be useful to look at the last couple of months to make sure you get a true picture of your spending habits. So settle in with your bank statement, credit card and PayPal account and write down all of your variable spending.

I find it useful to separate these costs into categories. The categories you choose will be personal to you and you can have as many or as few (and as specific or as general) as you like. I use the following titles to categorise my variable spending:

- Food (and household)

- Fun

- Miscellaneous

- Petrol

Once you’ve completed this exercise, you’ll be able to see roughly how much you’ve been spending in each category on a monthly basis (and it might be a bit of an eye opener). Now you’re armed with this information, you can decide if you’re happy with your spending and if not, set a budget for each category to keep costs down.

NUMBERS YOU NEED TO KNOW: OUTGOINGS – PART THREE (SINKING FUNDS).

If you thought we were done after variable expenses you’re going to have to stick around a little longer as we need to move on to sinking funds. This might be a completely new concept for you and it can be a little overwhelming at first so I will be writing a whole post solely decided to sinking funds but at this point, all you need to know is that these are things that you will have to pay for during the year but that don’t come out of your bank account each month. Think Christmas, or school uniform or home and car insurance (depending how you pay for it).

I make a list of these one off expenses, add them up and divide by 12 and I set that amount aside each month to save for them throughout the year so I’m not scrabbling to find money when the time (and the bill) comes. Sinking funds have been an absolute game changer for me and I’ll never go back to scrabbling around to figure out how to pay for Christmas presents or my car service again.

Once you’ve done this part of the exercise, add it all together and congratulations – you now know your monthly outgoings!

SO NOW I KNOW THE NUMBERS – WHAT NEXT?

Once you’ve done the maths and figured out the two key numbers that comprise your income and your outgoings – You’ve got yourself the basis of a basic budget and from here, the possibilities are vast.

If your finances are in good shape, this is the perfect time to set some financial goals. Consider what your priorities are and then review your expenditure to make sure that you are spending your money in a way that will support you to achieve your goals. If you find your spending to be out of alignment with where you want to be then you can make any necessary adjustments. By doing this, I was able to overpay my mortgage by £16,000 in the last few years despite having two babies in that time!

If, through this exercise, you discover that your outgoings are more than your income you can take action to reduce them. It may be as simple as setting and sticking to a budget your variable spending by cutting down on eating out.

If things are more serious and you discover that you’re in a deficit but there is no room to reduce your expenses then you may want to consider getting help from Citizens Advice or a debt charity such as StepChange to prevent yourself from sinking into (or further into) debt.

GO FORTH AND BUDGET!

By now I hope you’re feeling motivated to get to grips with those important figures. Being confident to take control of your finances by really understanding your numbers can empower you to better manage your money and potentially reach your own financial goals whether that be paying off debt, becoming mortgage free, saving for your children, a big life event or a holiday.

Once you become a personal finance pro you might even want to talk to others about what you’ve learned like I did and I now ramble daily about money to over 21,000 people on Instagram. Come and join the conversation, we’d love to hear how it’s going!

Don’t forget you can check out lots of free resources to help you feel more confident with numbers over on the National Numeracy website and you can take part in the numeracy challenge here.

Happy Budgeting!

Leigh